The Value of Financial Advice

By Michael Farmer CFP

The right words from the right person can have a lasting impact on the way we live our lives for the better.

The value of financial advice can mean different things to different people.

For some, great advice is measured through tangible results. The quality of advice could be determined by how much tax was saved or the earnings achieved on investments. It may even mean the speedy completion of a job through efficient implementation of paperwork and documents.

While other people prefer to focus on a sense of well-being instead. They feel reassured knowing their finances are correctly structured for a successful retirement strategy and are less stressed over their long-term financial security.

Whichever way you measure advice, the benefits can make a long-term difference emotionally, behaviourally, and financially. Initially, it will help combat possible indecisiveness with a clear and individually tailored plan.

Working with a Financial Planner can help you clarify your position and the options available to manage your finances better. Our clients are left feeling more financially secure, our advice contributes to peace of mind, and our clients have greater confidence in their decision making.

There is also a sense of accountability towards maintaining your goals while gaining valuable insight that allows you to adapt to ever-changing economic circumstances. If the last year has proven anything, it’s that nothing is for sure and the future is unpredictable. With a flexible and personalised strategy, it won’t matter what the next phase in life will bring.

Working with an experienced and qualified Financial Planner can:

- Help clarify what you want to achieve.

- Advise you what steps and actions you need to take.

- Provide well-researched, appropriate recommendations.

- Help you implement these decisions; and

- Provide ongoing monitoring and coaching of your strategies and investments.

One of the most valuable services we can offer our clients is that of a behaviour coach. A key asset is knowing exactly where you are and what you want to achieve, which provides the basis for the actions you should take to get there. With knowing what path to take and some steady guidance, we can financially educate you, help you maintain a long-term perspective, and stay disciplined during both the good times and the bad.

For example, when there are volatile times on the market, emotions can take over and affect how you invest. Abandoning an investment plan due to an emotional knee-jerk reaction can cost you by selling good assets off at low prices. Alternatively, chasing short-term returns and past performance can lower diversification, increase risk, and can result in losses.

Having the right advice and guidance can keep a steady hand on the wheel and help you avoid common behavioural tendencies that can throw you off track of your long-term goals.

Clients who take on board financial advice will be better off. We believe that when the average Australian obtains financial advice, it will likely add value to a person’s wealth by the time they retire.

A good plan will show you what strategies you can implement and articulate how you will be better off financially.

So, when is the right time to get advice?

They say the best time to have planted a tree was 20 years ago. The next best time is now. This same thought can be applied to financial advice. The sooner you act to save tax and create wealth, the better off you will be.

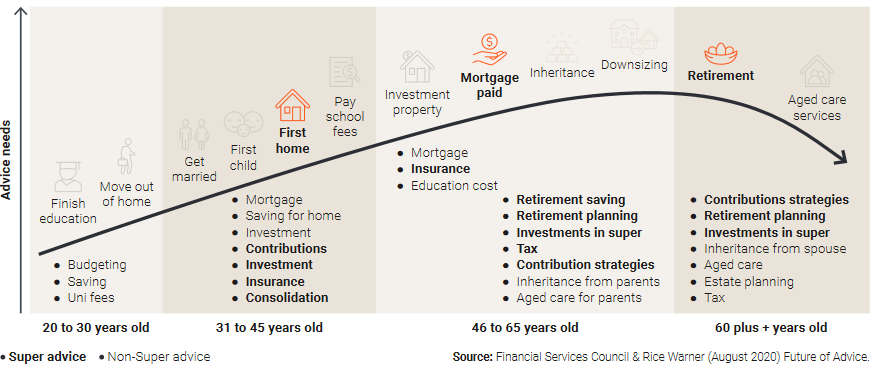

Financial advice can help at any stage in life. Clients looking for help can seek advice to navigate all the different opportunities and challenges that can present themselves during any stage of life.

The common life events that can trigger the need to obtain advice are:

How money much should I have?

Technically, you could start with nothing. All you need is the want to be better off financially, have the conviction to act, and put in place strategies to save and accumulate wealth.

At Business Initiatives, we believe that the right kind of financial advice can make a big difference to your economic well-being, giving you peace of mind knowing that professionals are looking after your best interest.

We know that most people we speak to can usually do more to improve their financial position and grow their wealth. Tailored financial advice can play a significant role in assisting you to take control and obtain the security everyone deserves.

We can help you with:

- Saving Plans

- Superannuation & Retirement Planning

- Investments

- Estate Planning

- Aged Care

- Redundancy Planning

- Budget Management

- Tax Minimisation Strategies

- Personal Insurance Protection

- Centrelink

- Debt Management

- And more…

We can help provide you with a tailored and unique plan for you designed to improve your financial security throughout your life.

It’s your life. Make the most of it.

The information contained in this article has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs. You should, before you make any decision regarding any information, strategies or products mentioned in this article, consult your own financial advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs.