What To Do When The Share Market Falls

By Michael Farmer CFP

What’s happening at the moment?

Bad news always makes the headlines. 2022 has started on a sour note as markets worldwide have fallen from their recent highs, which understandably makes investors nervous. Panic sells screen time on TV, while calm markets don’t.

There is a range of factors spooking the market at the moment:

- A sharp rise in inflation in the US

- The US Reserve and other central banks are indicating interest rates will rise

- Omicron has disrupted the expected reopening of the world’s economic activity

- Russia is causing angst with Washington over Ukraine and its potential involvement in NATO

- Share markets have had huge gains since the March 2020 lows.

What you should keep in mind

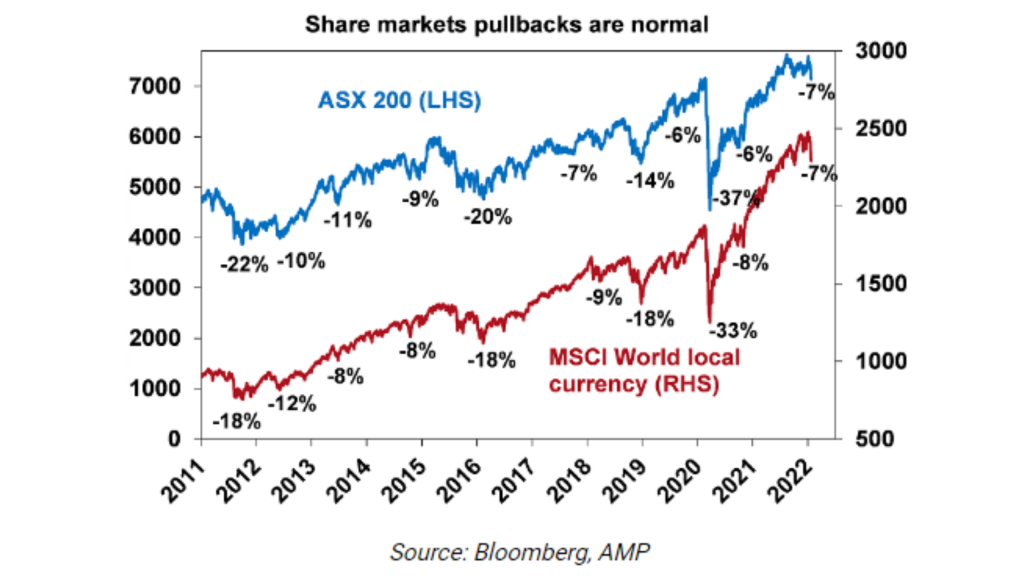

1. Downturns happen regularly, and you should expect fluctuations in values. While painful, corrections in the market help limit excessive risk-taking and are paid for in the higher long term returns that the share market enjoys. The ASX has had 11 downturns over 5% over the last 11 years, including 3 over 20%! Since 2012 the ASX (not including dividend returns) has grown from 4000 to 7000 points.

2. With all the volatility in the market, there is some good news out there. The world’s growth in 2022 should be strong at 5% and Australia at 4%, as the world continues to grow after the Covid related shutdown. Omicron is slowing, and most of the world is getting back to business. Excess global savings of 2.3 trillion (including $250 billion in Australia) is sitting there waiting to be spent. Global supply blocks are being sorted, inventories are being restocked (this will help lower inflation), and housing prices are strong. And lastly, unemployment is at record low levels in the US and very low even in Australia. There is no talk of recession, and I can’t see one happening this year.

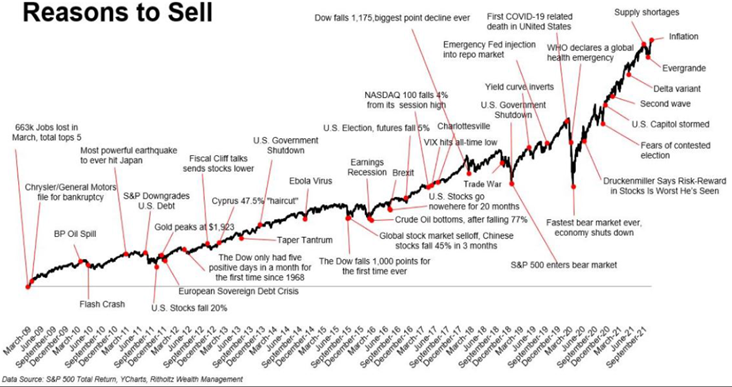

3. There are plenty of reasons to sell, but if you reacted to every bit of bad news, you’d never get anywhere. Notice below that the market keeps climbing over the long term with all the goings-on and noise.

4. When you sell your shares during a downturn, you crystalize the loss. I don’t have many clients that cash out during downturns, but I have come across plenty of people who have taken on too much risk and sold out cheap. Even if they avoid some further falls, having the confidence to re-enter the market takes time and by the time they do, the opportunity to gain is missed. Anyone who tells you they can do it, ask them for next week’s lotto numbers! Market timing is almost impossible.

5. Why sell good assets cheaply? If you invest in quality companies that will be there making profits over the long term, why sell them at a discounted price? The person buying them off you is getting them cheap. If you take action about your investment portfolio, now is the time to buy.

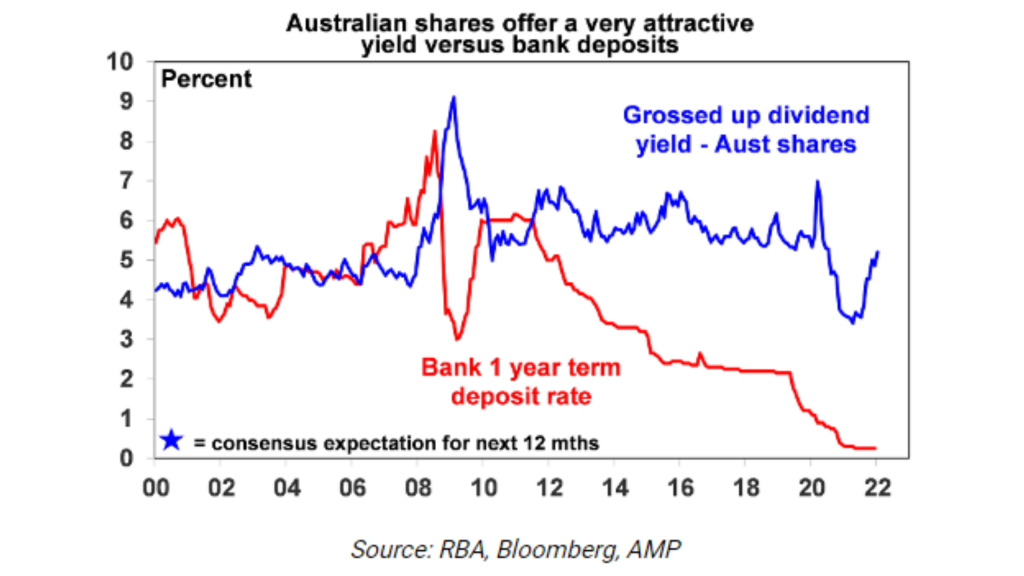

6. You’ll make better income from shares than bank deposits. During this short-term volatility, you’ll notice people don’t automatically change their lifestyle, behaviours and, most notably, spending patterns. Companies try to be consistent in their dividend payments, and growth in their income is the best determinant of asset growth over time. The below graph shows the tracking of dividend yields vs bank deposit rates over time.

7. Buy low and sell high seems like common sense. Why do it the other way around?

So, what to do?

During these negative returns and headlines, you have to grin, bear it, and wait until the market wakes up on the right side of the bed and acts positively again.

If you have a long-term investment strategy in place that has been designed to be invested within your personal level of risk tolerance, keep true to the strategy as this volatility will finish, and good returns will follow.

It has always happened this way; it always will.

All the best with your investing,

Michael

Michael Farmer (AR 328367) is a Representative of Wealth Initiatives Pty Ltd

ABN 54 612 640 641 and AFSL 509563

www.businessi.com.au answers@businessi.com.au 08 8431 7444